Description

Course Outline:

- DEFINITION; PHASES OF ACCOUNTING; PURPOSE AND IMPORTANCE OF ACCOUNTING; USERS OF FINANCIAL INFORMATION

- BUSINESS TRANSACTIONS DEFINED

- ACCOUNT; CLASSIFICATION OF ACCOUNTS

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

- GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAPs)

- THE ACCOUNTING EQUATION · THE THEORY OF DEBIT AND CREDIT

- CHART OF ACCOUNTS · THE ACCOUNTING CYCLE

- Journalizing / Preparing Accounting Entries

- Posting

- Preparing the Trial Balance

- Adjusting Entries

- Depreciation

- Amortization

- Bad Debts

- Prepaid Expenses

- Accrued Expenses

- Accrued Income

- Deferrals

-

- Closing Entries

- Preparing the Post-Closing Trial Balance

- BASIC FINANCIAL STATEMENTS

- Preparing the Balance Sheet

- Preparing the Income Statement

- Introduction to the Statement of Changes in Equity

- Introduction to the Statement of Cash Flows

- ANALYSIS OF FINANCIAL STATEMENTS

- Objectives of Financial Statement Analysis

- Types of Analysis

- Horizontal

- Vertical

- Trend

-

- Steps in Analyzing Financial Statements

- Financial Ratios

- Exercises: Financial Statement Analysis

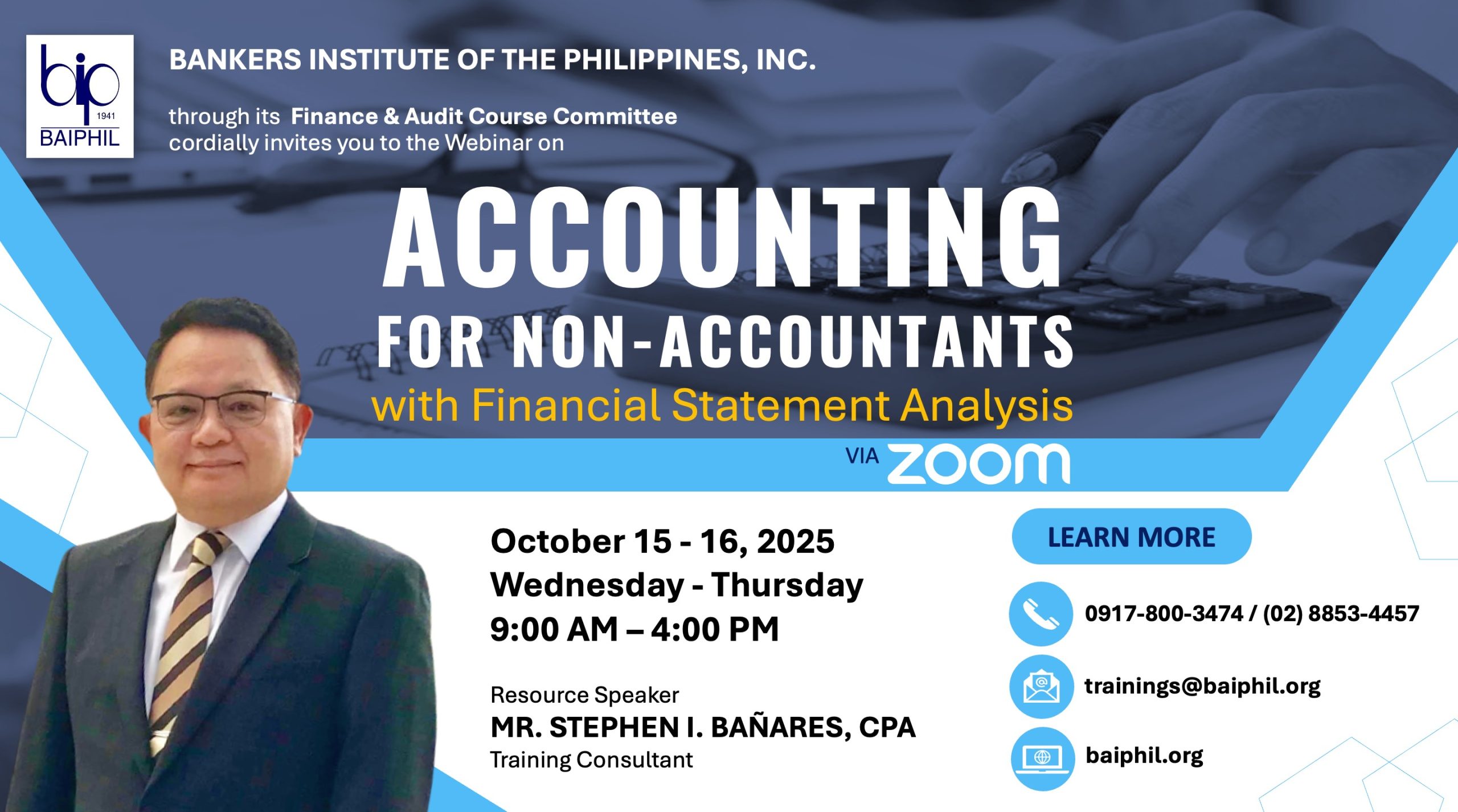

Resource Speaker

Mr. Stephen I. Bañares, CPA

Training Consultant

Schedule:

October 15-16, 2025 (Wednesday-Thursday) 9:00 AM – 4:00 PM

Training Fee:

Member Institution – Php 7,840.00

Non-Member Institution – Php 10,080.00

*VAT inclusive