Description

Course Description:

The Credit Lending Process module is intended to familiarize the participants with the entire borrowing process within a bank, from how a potential borrower is chosen, evaluated for his creditworthiness, presented for approval, documented for implementation, serviced and monitored for account maintenance, and potentially renewed at the same level or possibly for higher limits. Two additional steps have also been added, remedial management for problem accounts and ROPA management for foreclosed assets. In the end, the participant will be very knowledgeable on how an account gets approved and maintained throughout its borrowing life.

Program Objectives:

By the end of this course, participants will be able to:

- Understand the importance of a high-quality credit process

- Know the different steps of the credit lending process and the significance of each step in the whole process

- Know the consequences of non-compliance and the impact on the overall asset quality and profitability

Course Outline:

- Credit Lending Process

- Account Identification

- Credit Initiation

- Credit Investigation

- Credit Appraisal

- Credit Assessment / Risk Rating

- Credit Structuring / Packaging

- Credit Proposal Preparation

- Credit Approval

- Post-Approval Documentation

- Loan and Collateral Documentation Review

- Credit Implementation

- Account Maintenance

- Credit Risk Monitoring

- Remedial Management

- ROPA Management

Target Participants:

- Credit Officers

- Account Officers

- Credit Analysts

- Account Associates

- Marketing Associates

- Credit Policy Officers

- Credit Review Officers

- Branch Operations Officers

Resource Speaker:

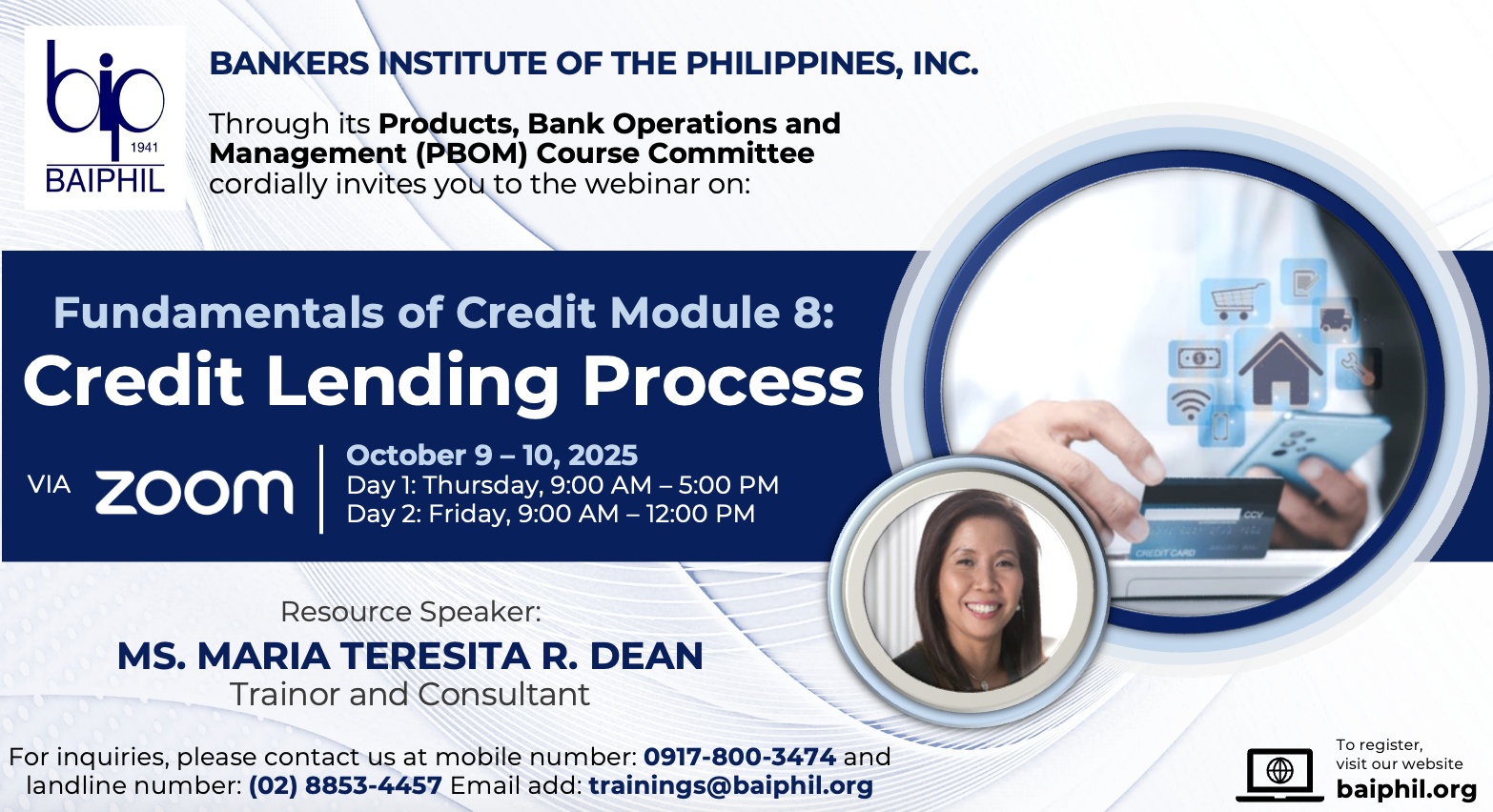

Ms. Maria Teresita R. Dean

Trainer and is a highly-experienced senior management professional with over thirty-nine years of credit and collections management, risk management, account management and distressed assets management background in both domestic and international markets.

Schedule:

October 9-10, 2025 (Thursday-Friday)

Day 1: 9:00 AM – 5:00 PM

Day 2: 9:00 AM – 12:00 PM

Training Fee per Participant:

Member Institution – Php6,720.00

Non-Member Institution – Php8,960.00

*VAT inclusive